Raising Money-Savvy Kids: A Comprehensive GoHenry App Review

How Kids Can Master Money Management with an App

If you are a parent, you might strive to instill a sense of financial responsibility in your children from an early age, and GoHenry might be the perfect companion on this journey. In this review, we'll delve into the features, benefits, and user experience of GoHenry, exploring how it offers a safe and educational platform for kids to learn about money in a fun and interactive way. Join us as we uncover how GoHenry is transforming the way families approach pocket money and financial education, helping kids develop lifelong money management habits and preparing them for a financially secure future. Let's dive into the world of GoHenry and see how it can revolutionize the way your family handles money.

GoHenry is an award-winning pocket money app and debit card that promises to be a valuable tool in any kids savings endeavor. Designed specifically for kids aged 6 to 18, GoHenry aims to teach money management skills while providing parents with peace of mind.

INITIAL IMPRESSIONS

A few years ago one of our crew members was planning a trip with their family. Their son wanted to save some cash for the upcoming trip and set out to find a great way to save, spend (without carrying cash) and plan for the trip ahead. After initially trying Greenlight App, they switched over to GoHenry. The reason for the switch? Well, after ordering a card from GreenLight and it never arriving, they decided they would try GoHenry. Now 2 years later, GoHenry is still their top pick for helping save, plan and spend money anywhere.

The user-friendly interface of the GoHenry app is by far one of the easiest to navigate. It is designed to be engaging and accessible for both kids and parents and the colorful graphics and interactive features make it fun for kids to use, while the clear layout and easy navigation ensure parents can quickly manage their child's account.

One of the most appreciated aspects of this app/debit card is the level of control and flexibility the app provides. Setting up an account and allocating pocket money to your kids is straightforward, and the ability to set spending limits and restrict certain categories provides peace of mind.

Additionally, the educational aspect of the app is highly regarded. Many find the financial tasks, goal-setting features, and quizzes valuable in teaching their kids about money management in a practical and engaging way.

Overall Features of GoHenry:

Safety and Security: With GoHenry, personal information is safeguarded through strict security protocols. The app allows parents to maintain control, set spending limits, and monitor transactions in real-time, ensuring their child's financial safety.

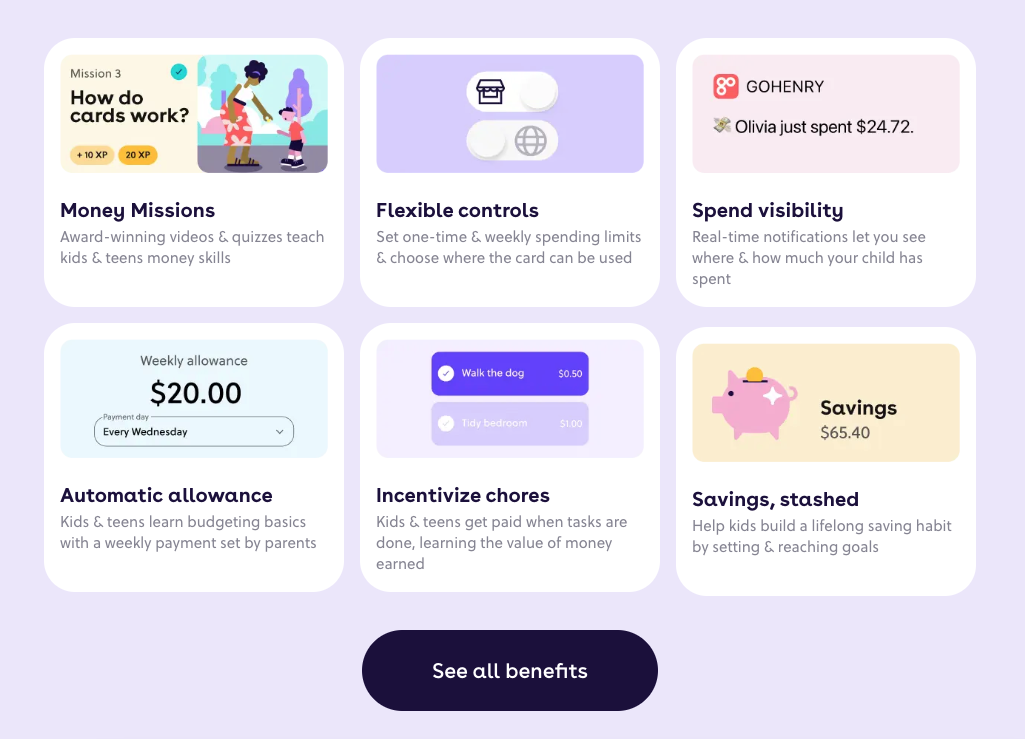

Educational Tools: GoHenry's true strength lies in its educational approach to money management. By using the app, kids can learn the value of money, budgeting, and saving. Parents can set weekly allowances and allocate chores for earning money, teaching kids the connection between work and money. Through interactive quizzes and financial tasks, GoHenry empowers kids to make smart financial decisions independently.

Parental Control: GoHenry offers parents a high level of control and transparency. With the app, parents can instantly block or unblock the card, set spending limits, and even restrict specific categories of spending. This feature ensures that kids are gradually introduced to responsible spending habits while still under the guidance of their parents.

Real-World Experience: GoHenry provides kids with a tangible connection to the real world, teaching them to use a debit card responsibly. This real-world experience prepares children for financial decisions they will face later in life, building their confidence and responsibility.

Interactive App: GoHenry's user-friendly app is designed with kids in mind. It offers colorful graphics, goal-setting features, and achievement badges, making the learning process engaging and fun. The app encourages financial literacy through interactive quizzes and money-related challenges, making money management an enjoyable experience for kids.

Parent-Child Collaboration: GoHenry fosters collaboration between parents and kids in managing finances. Through the app, parents can discuss spending decisions and financial goals with their children, reinforcing the value of open communication about money matters.

Customer Support: GoHenry's customer support team is highly responsive and readily available to address any concerns or inquiries. Parents can feel confident knowing they have a reliable support system behind them as they guide their children towards financial independence.

How GoHenry Benefits

Sign up, Set a Goal, Spend and Save.

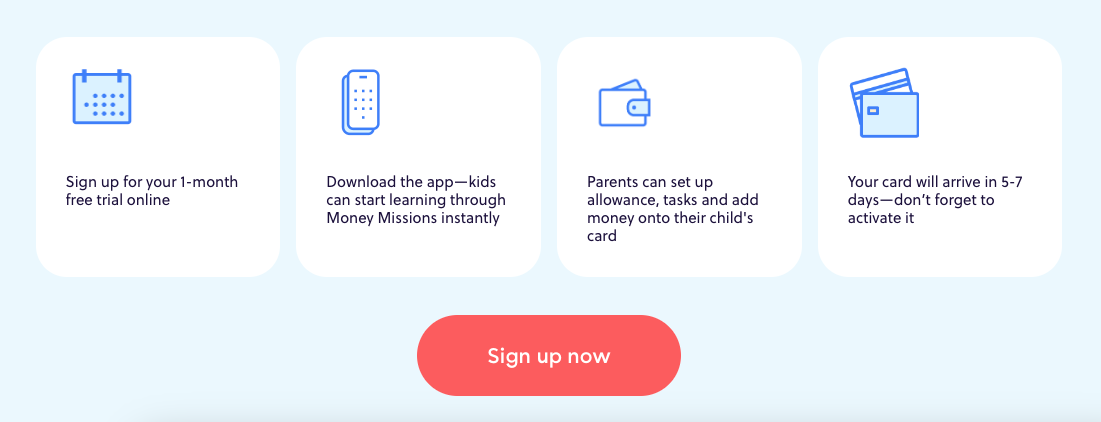

Getting started with GOHenry is realtively simple and straightforward. Here is how GoHenry works:

Setting Up Accounts:

Parents start by creating a GoHenry account for their family and linking it to their bank account. They then set up individual accounts for each child, customizing their profiles with names, photos, and personal preferences. To start you can join on a free trial and get access to all GoHenry features free for 30 days. After your free trial, it’s charges your bank $4.99 per child per month. For families with up to four kids, it’s $9.98 per month.

***The fee is somewhat a pain in the side each month, but it does give you the benefit of having the card, app, and educational aspects that is offsetting of these charges.

Optional Features to Add:

Parents can decide on a weekly allowance amount for each child. This virtual pocket money is automatically transferred into the child's GoHenry account on a designated day, providing a regular income to manage. To encourage a work-reward dynamic, parents can assign chores and tasks for their kids to complete. Each completed task earns the child additional money, which is credited to their account upon verification. We found that the transferring of money into the account is easy- and goes in right away. The reward of seeing cash hit your kids account is pretty cool.

The Card Itself:

Upon setup, the GoHenry debit card arrives soon after picking the unique and custom look. This card is linked to the GoHenry account and can be used for spending both online and in-store wherever Mastercard is accepted. One of GoHenry's key features is the level of control it gives parents. Through the app, parents can set spending limits, restrict specific categories, and block or unblock the card instantly. This ensures that kids spend responsibly while still providing them with some independence. GoHenry allows kids to set savings goals, fostering a habit of saving for something they want. Parents can monitor their progress and contribute to these goals as rewards for good behavior or achievements. Some additional benefits of the card and app also focus on:

Financial Tasks and Quizzes: The GoHenry app offers interactive financial tasks and quizzes that help kids learn about money, budgeting, and making smart financial decisions.

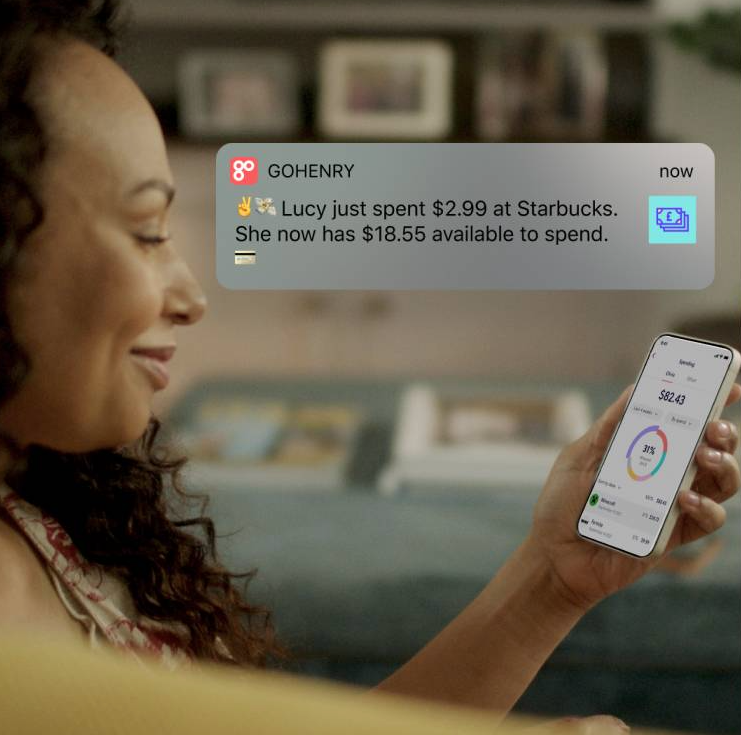

Real-Time Monitoring: Parents can monitor their child's spending and transactions in real-time through the GoHenry app, giving them full visibility and ensuring their child is making responsible choices.

Educational Reports: GoHenry provides parents with detailed reports that show their child's spending habits, savings progress, and financial growth over time. This helps parents identify areas for improvement and support their child's financial education.

Money management skills for life

Want to help your child understand the value of money? You can also use GoHenry as a weekly allowance app. Whether they’re a spender or a saver, they can track their balance and learn budgeting skills as they go.

Overall, GoHenry streamlines the process of saving, tracking, and learning about money. Money is something we should be talking to our kids about, and GoHenry makes that conversation easy and fun. We found that after two years of use, the card does a great job of tracking spending, setting savings goals, and showing kids the real world use of plastic money when traveling or shopping.

STANDOUT FEATURES

GoHenry offers several standout features that make it a popular choice for parents looking to help educate their kids on money- and how to use/spend it wisely.

Financial Education: GoHenry's primary focus is on teaching kids about money management and financial responsibility. Through interactive tasks, quizzes, and goal-setting features, GoHenry fosters a practical and engaging learning experience, helping kids develop crucial money skills from a young age.

Parental Control: GoHenry empowers parents with a high level of control over their child's spending. Parents can set weekly allowances, allocate funds for specific tasks or chores, and even customize spending limits for different spending categories. This feature allows parents to guide their kids' financial decisions while still giving them some autonomy.

GoHenry Debit Card: Each child receives their own GoHenry debit card linked to their account. This Mastercard-enabled card can be used for online and in-store purchases, teaching kids how to use a debit card responsibly and instilling a sense of real-world financial experience.

Savings Goals: GoHenry encourages kids to set savings goals for things they want to purchase. They can track their progress, and parents can contribute to these goals as rewards for good behavior or achievements. This feature promotes a habit of saving and working towards financial objectives.

Chores and Tasks: GoHenry allows parents to assign chores and tasks to their kids, which can be completed to earn additional money. This feature instills the importance of work-reward dynamics, teaching kids about earning money through hard work and responsibility.

Educational Reports: Parents receive detailed financial reports that show their child's spending habits, savings progress, and overall financial growth. These reports provide valuable insights for parents to discuss and guide their children's financial journey effectively.

Real-Time Monitoring: The GoHenry app allows parents to monitor their child's spending and transactions in real-time. This transparency enables parents to discuss financial decisions with their kids and intervene if necessary.

GoHenry's standout features revolve around its commitment to financial education, parental control, real-world experience, and practical tools for teaching kids about money management. By combining these elements, GoHenry empowers kids with essential money skills, preparing them for a financially responsible future.

GoHenry Overall duuude Factor: Fun and educational way to teach kids about money

Price: Free Trial, then $4.99/month after-

Use our link and get $10 free allowance and one month FREE when you activate your child’s card.

Brand Info

Our Story

We want our kids to be smart with money, understand wants vs. needs, create savings habits, make investment decisions, use money to help others, take responsibility and understand when it’s gone, it’s gone. We created GoHenry with the goal of helping kids and teens learn about money in a practical, fun way and provide all the tools to help parents nurture healthy financial habits in their children.